Remote Deposit Capture

Please read the Remote Deposit Capture Terms and Conditions when enrolling in RDC to understand your rights and responsibilities, and how to use RDC.

Brooklyn Coop does not charge a fee for RDC. You may incur data fees from your mobile service provider.

How to Enroll in RDC

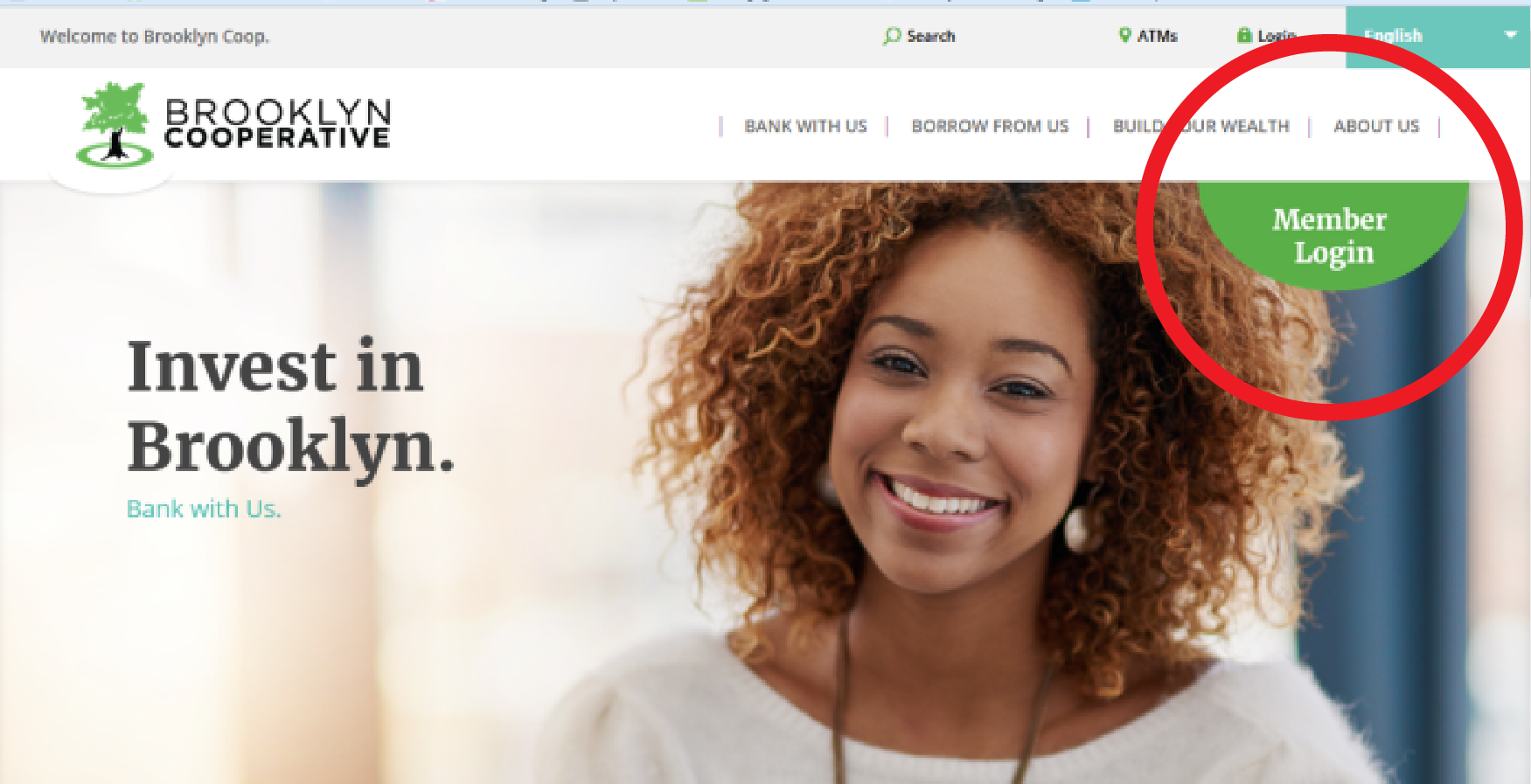

Enroll in Brooklyn Coop’s online banking. Set up your online account from a desktop computer at brooklyn.coop.

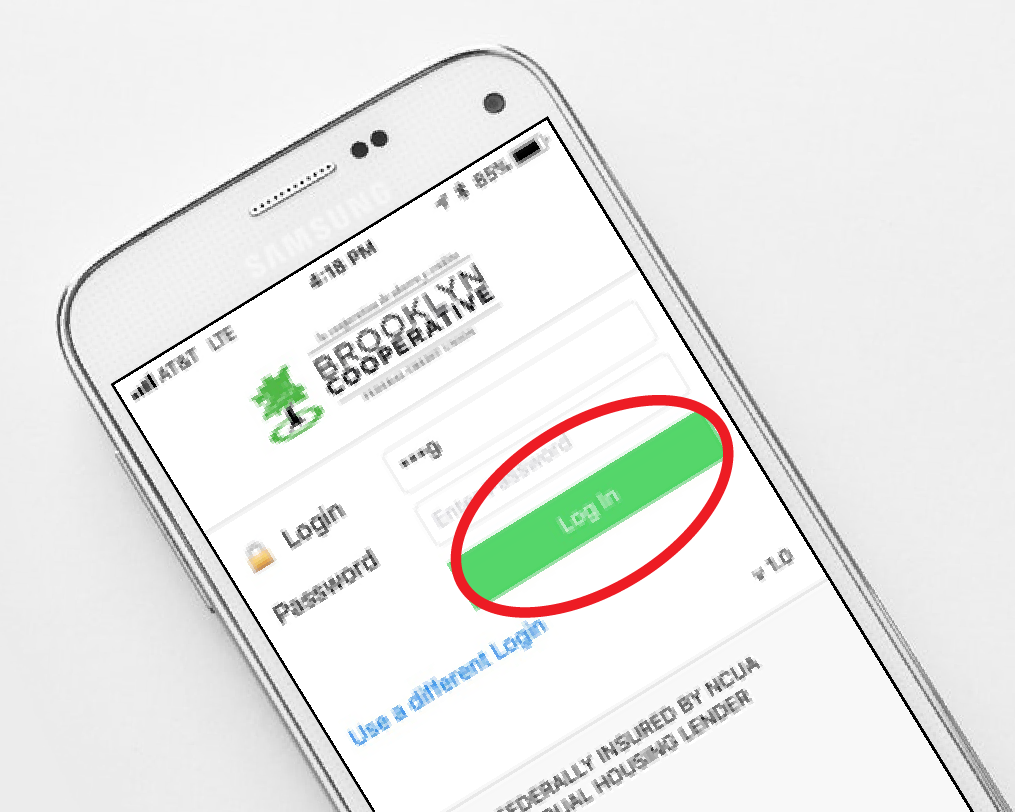

Download the BCoop mobile app onto your smartphone or tablet.

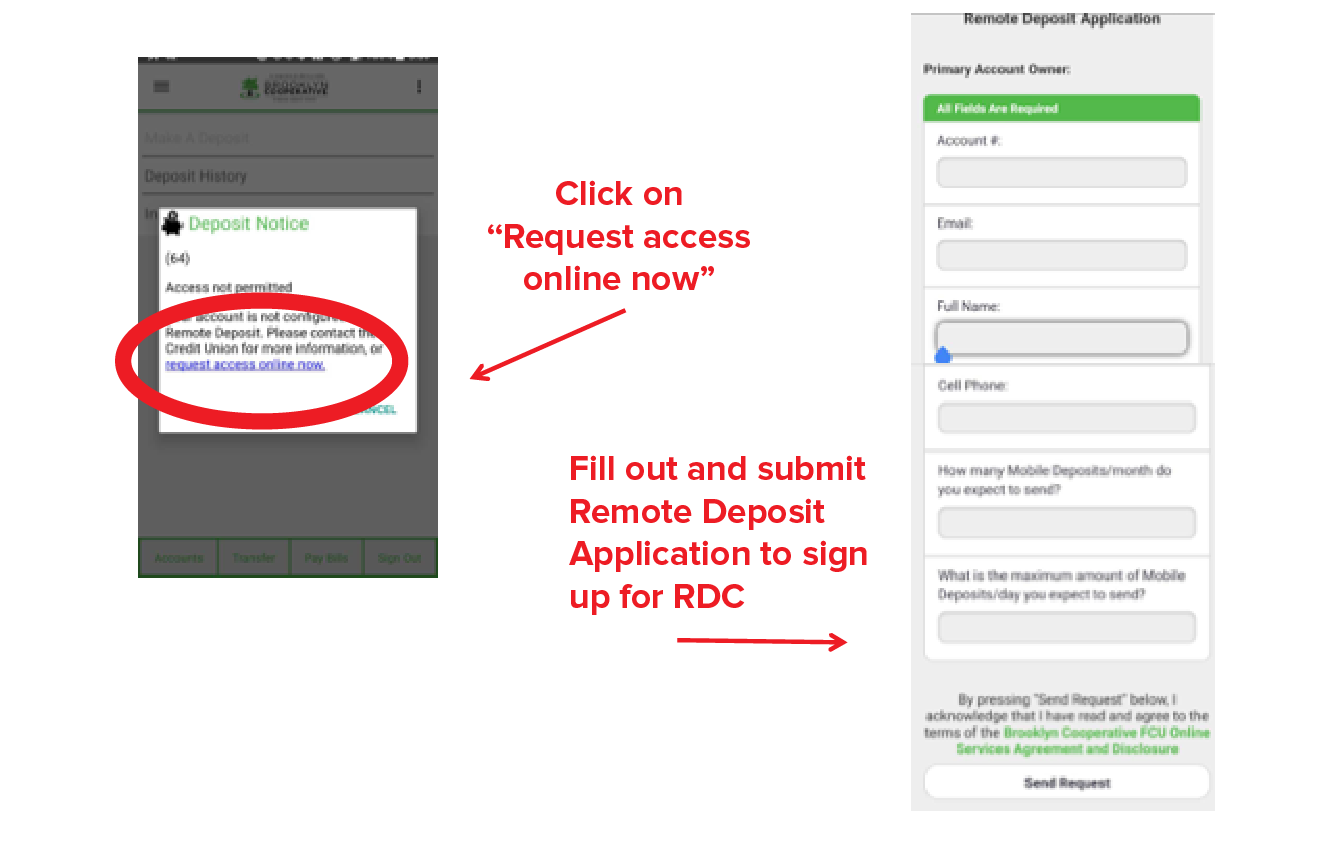

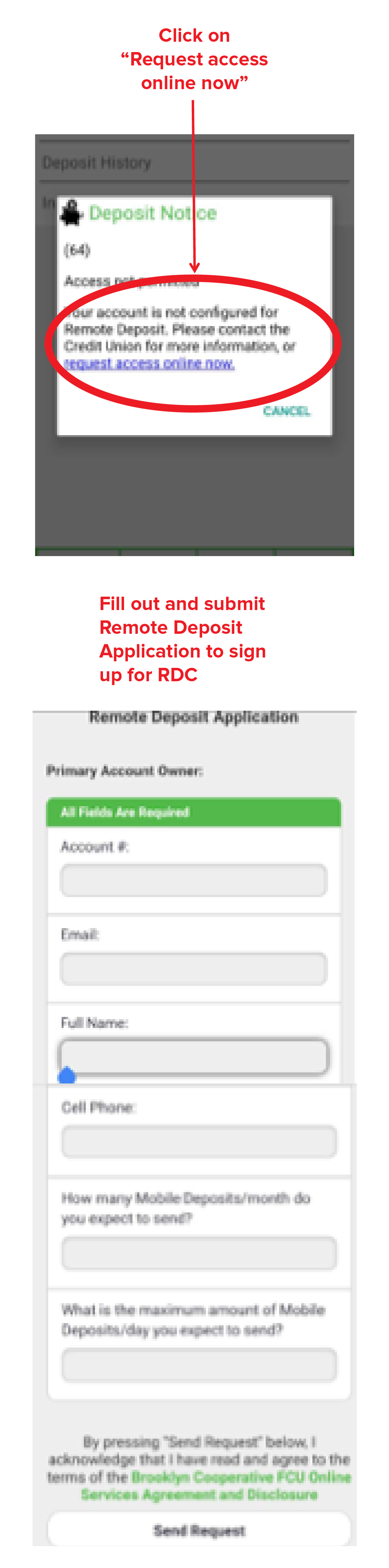

It will tell you that you must enroll first, which you do by filling out a form. You will also be asked to confirm that you are “not a robot,” a necessary step for preventing fraudulent accounts.

We will inform you in 2-3 business days whether you are enrolled and what your daily deposit limit is.

How to Enroll in RDC

Enroll in Brooklyn Coop’s online banking. Set up your online account from a desktop computer at brooklyn.coop.

Download the BCoop mobile app onto your smartphone or tablet.

It will tell you that you must enroll first, which you do by filling out a form. You will also be asked to confirm that you are “not a robot,” a necessary step for preventing fraudulent accounts.

We will inform you in 2-3 business days whether you are enrolled and what your daily deposit limit is.

How to Deposit Your Checks

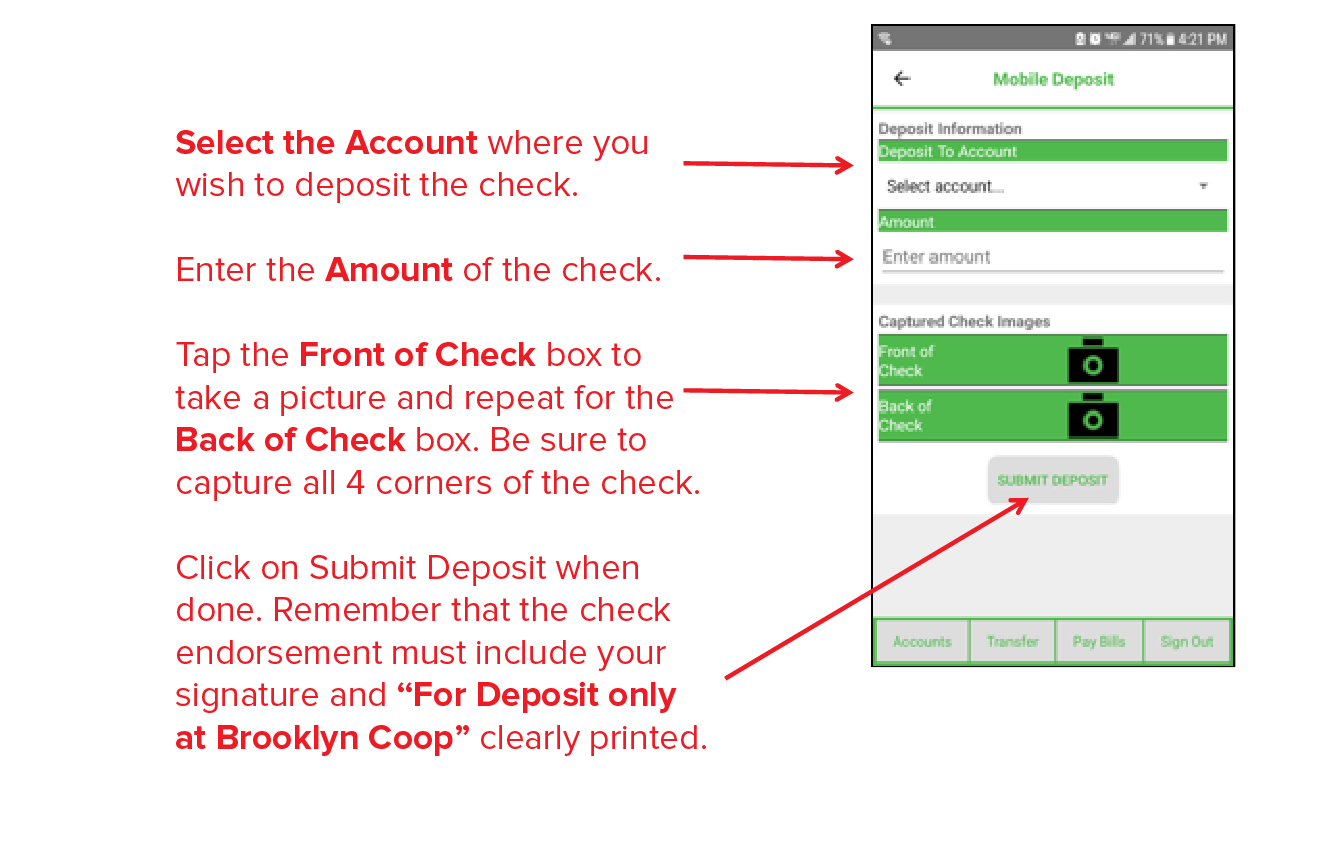

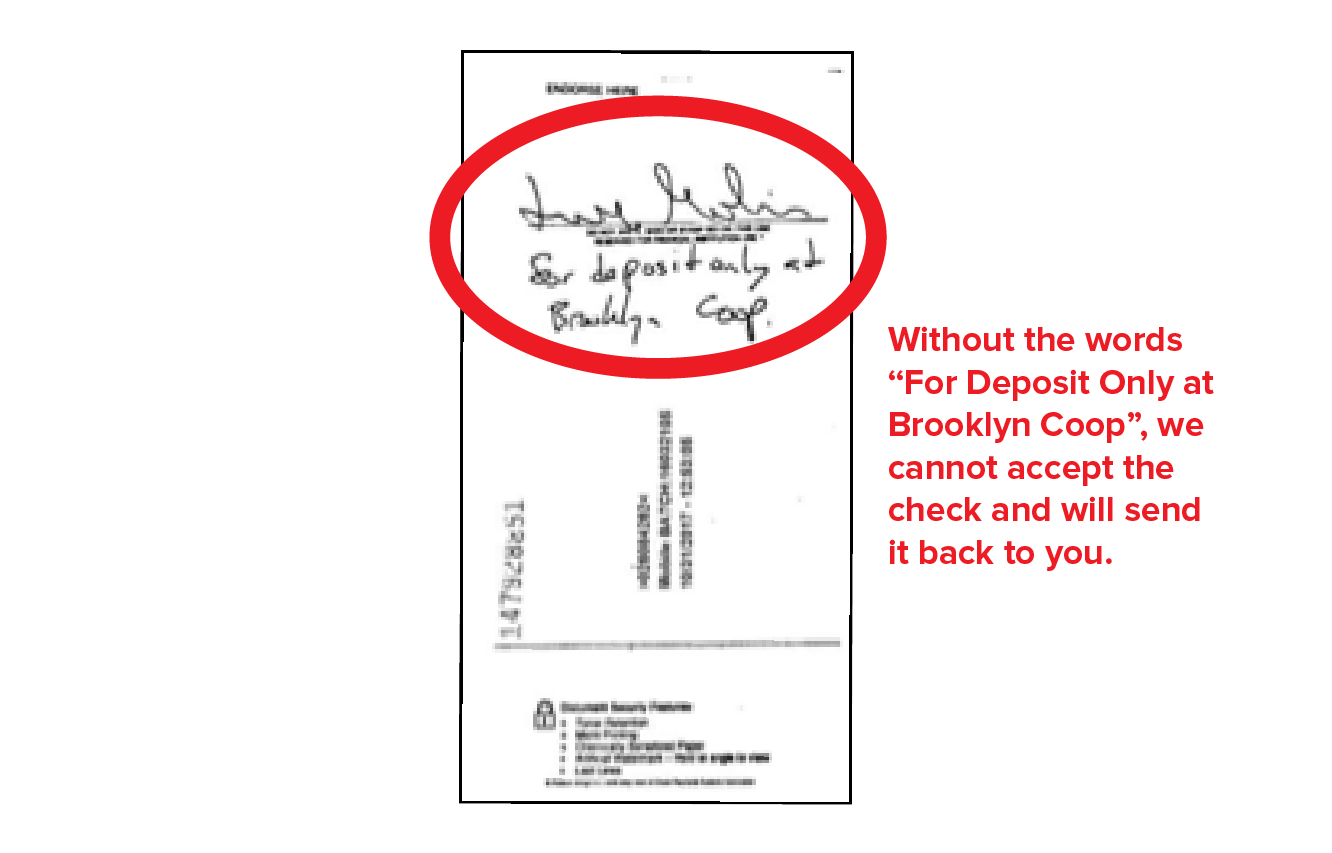

Endorse the back of your check with your signature, account number, and the words ‘FOR DEPOSIT ONLY AT BROOKLYN COOP.’

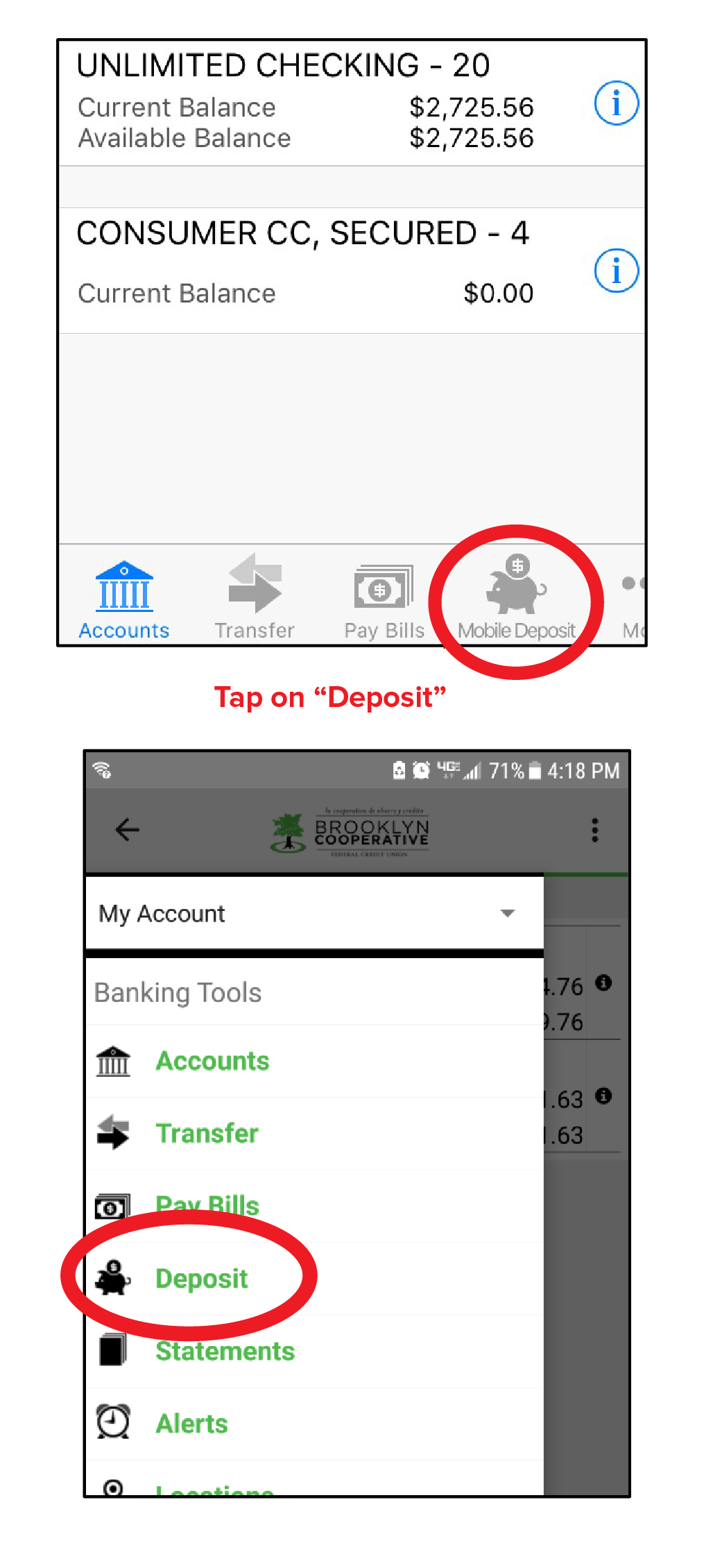

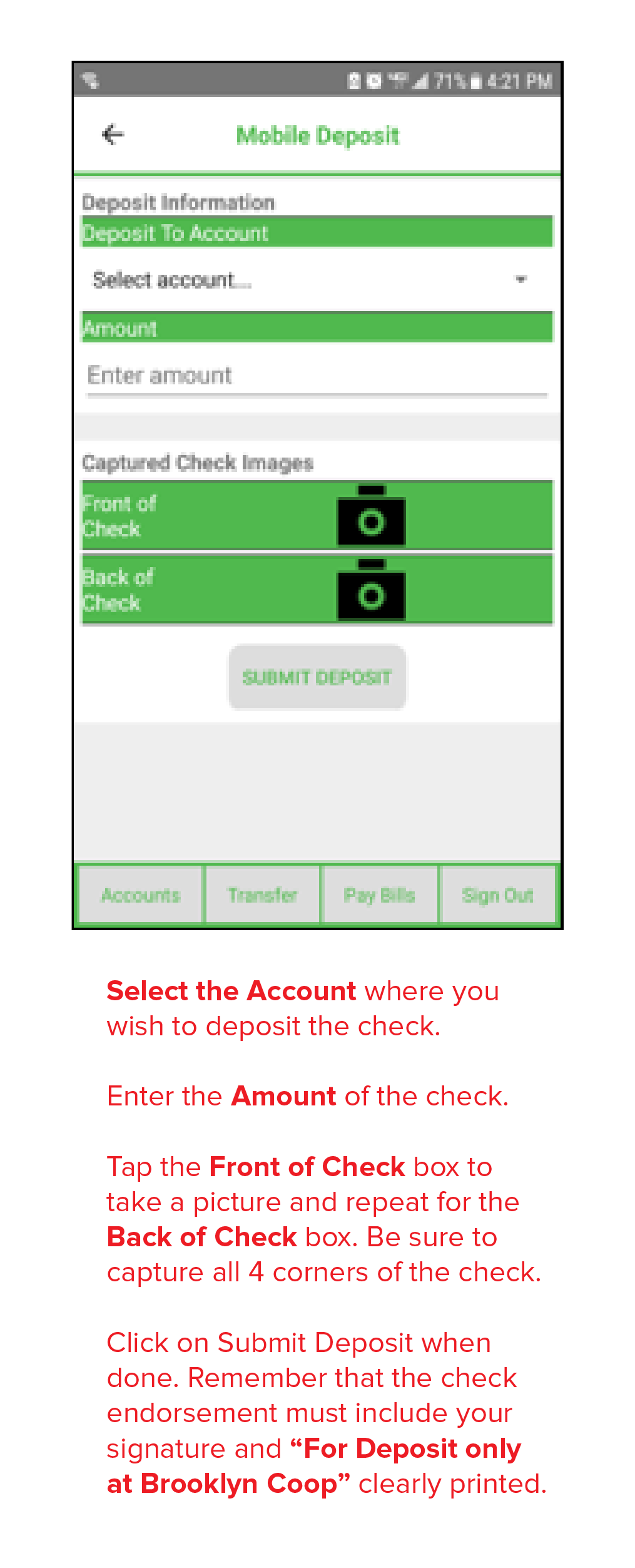

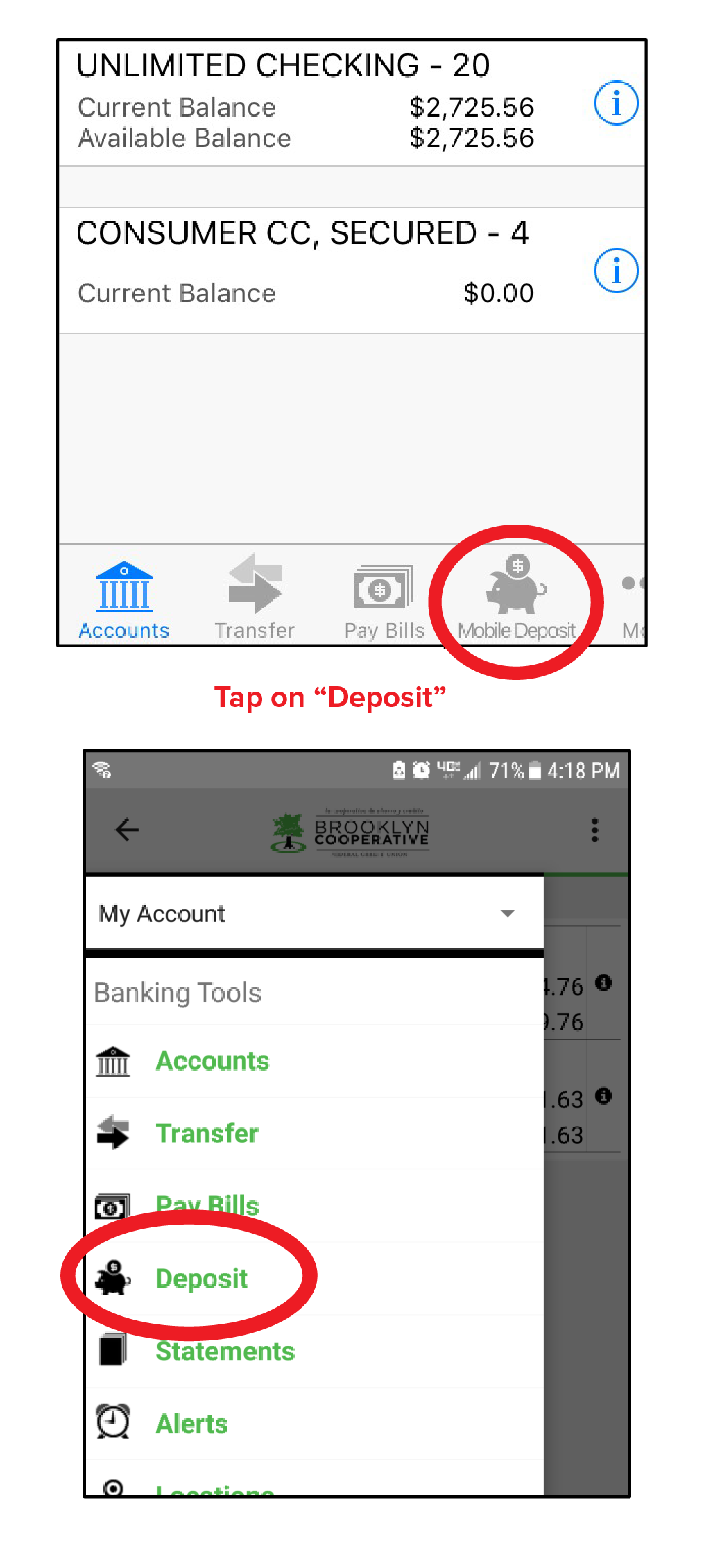

Open the mobile app and click on ‘Make a Deposit.” Follow prompts and instructions to capture the check data.

How to Deposit Your Checks

Endorse the back of your check with your signature, account number, and the words ‘FOR DEPOSIT ONLY AT BROOKLYN COOP.’

Open the mobile app and click on ‘Make a Deposit.” Follow prompts and instructions to capture the check data.

FAQ’s

Who can use RDC?

- Must not have any accounts in a charge-off status

- Must not have more than two overdrafts or bounced checks within the last year

How do I endorse my check?

Are there time restrictions for submitting checks to the bank?

What should I do with the original paper check after I make the deposit?

When will I be able to see the deposit in my account?

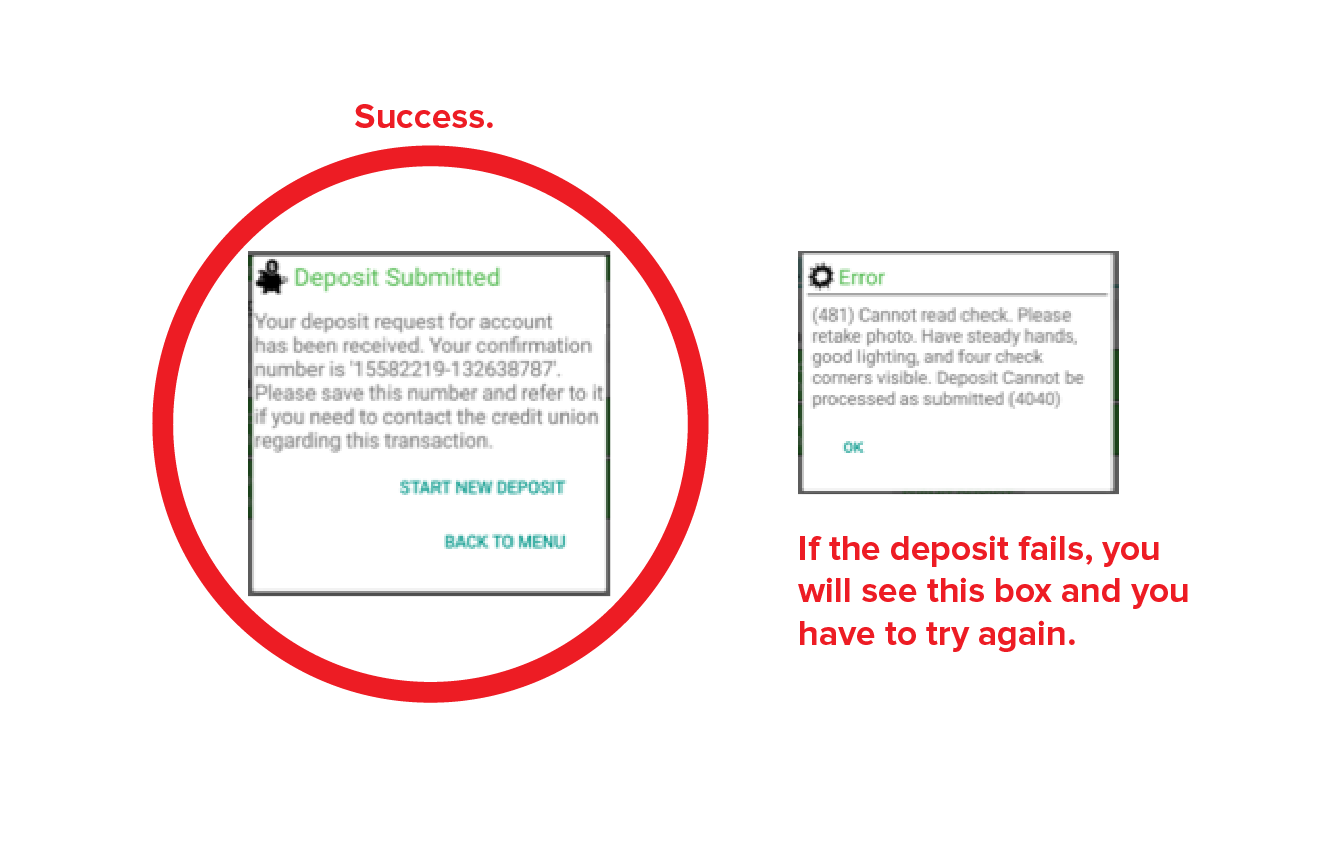

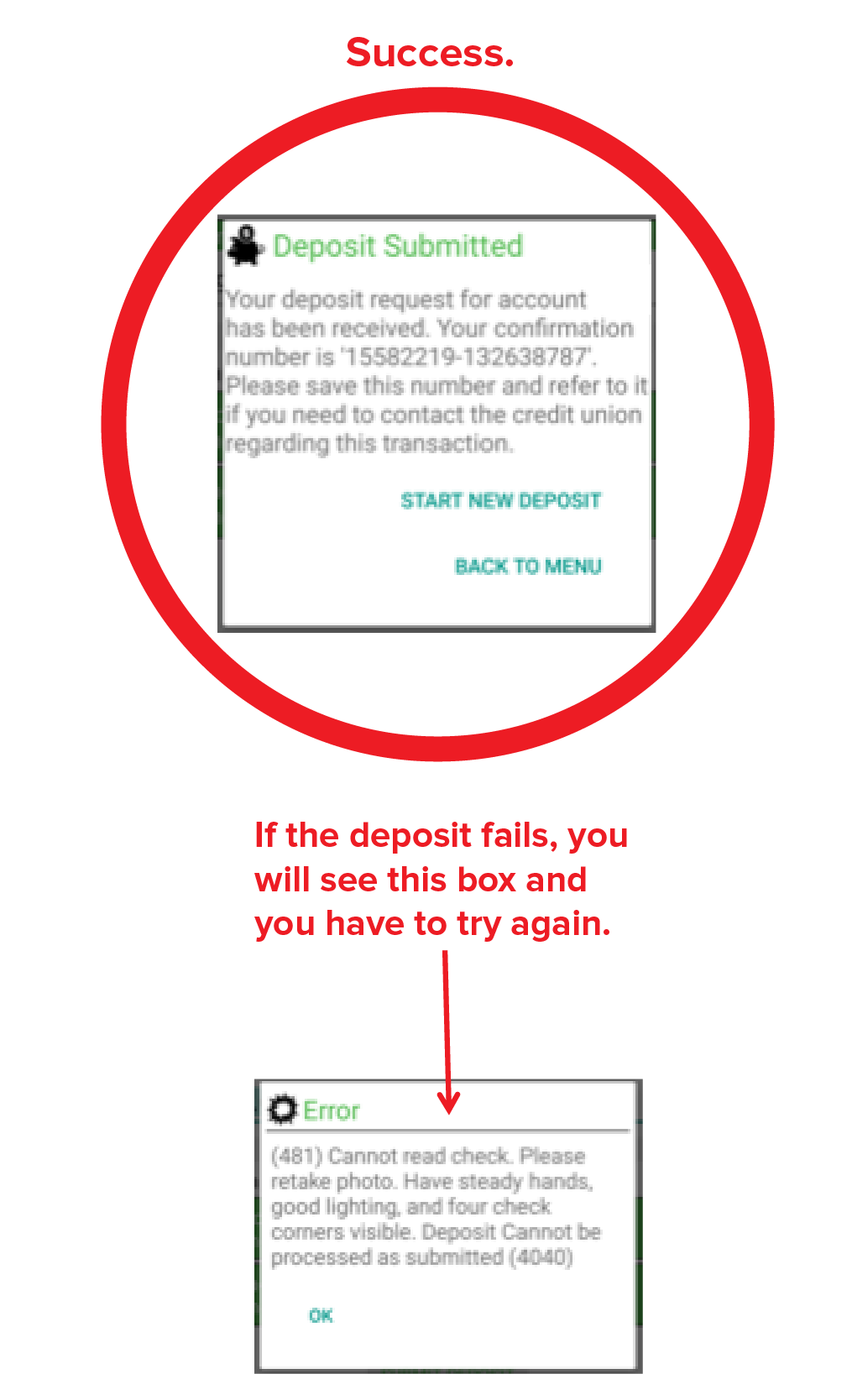

How will I know if my deposit has been accepted?

What type of checks can be deposited using RDC?

What type of checks cannot be deposited using RDC?

- Travelers Checks, and Savings Bonds

- Checks payable to any person or entity other than the account holder(s)

- Checks drawn on your account either with us or another institution

- Checks that are more than 6 months old, unless stated otherwise on the check

- Items that are stamped with a “non-negotiable” watermark

- Checks containing evidence of alteration to the information on the check