Don’t Get Tricked Into High-Priced Debt

Posted by Samira Rajan on Jan 27 2024

MoMA put on an exhibit of paintings by the American artist Edward Ruscha recently. I like Ruscha’s pop culture style and I love his color palette. I spent a lot of time in front of two giant paintings of an ordinary gas station, one at night and one during the day. Somehow they were mesmerizing to me. Ruscha creates such strong emotion using straight lines and simple flat colors. With maybe three color changes, the scene goes from day to night and evokes a very different emotion. Super cool artist.

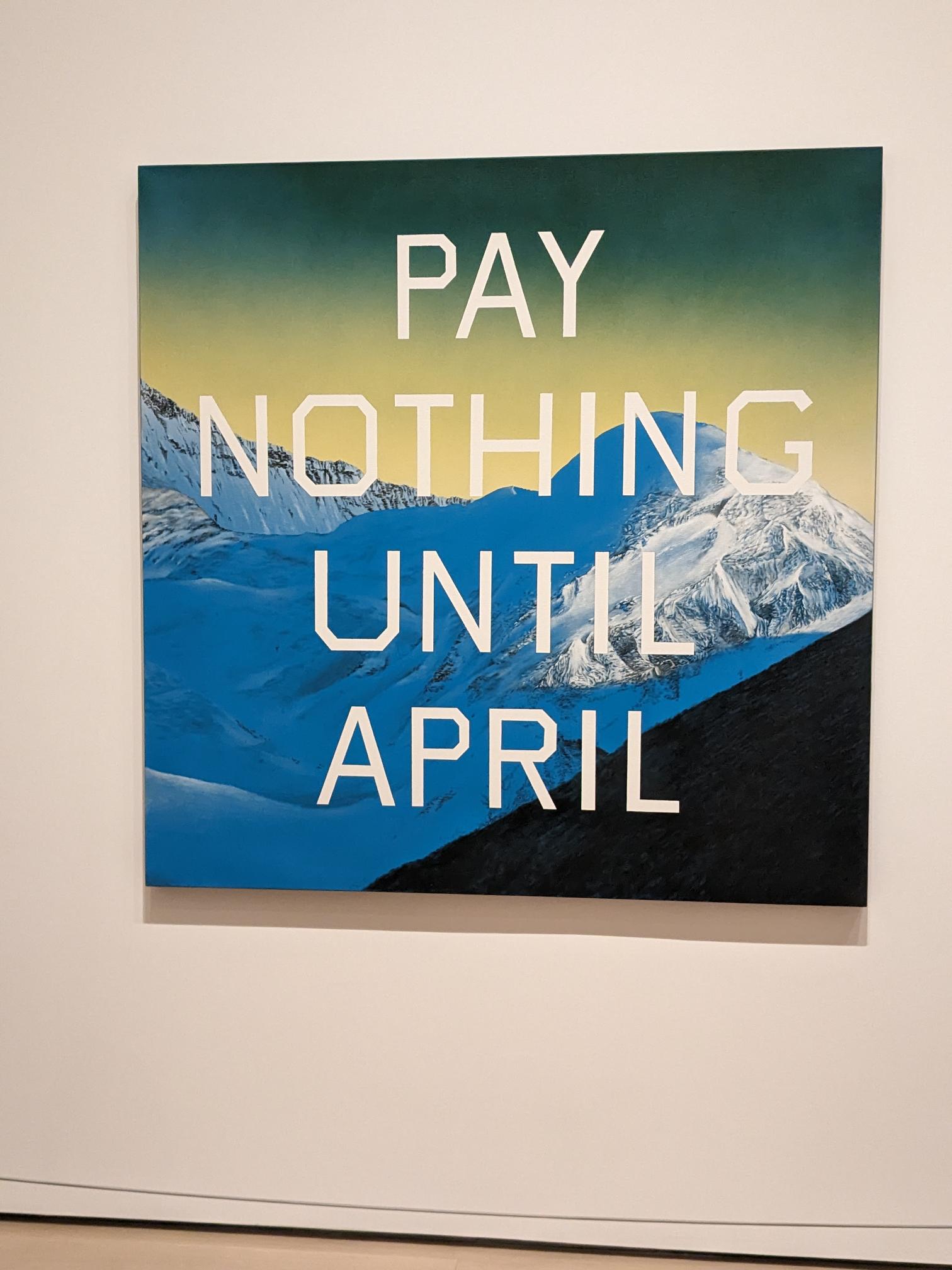

I snapped a pic of the painting ‘Pay Nothing Until April’ because it also created a strong emotion in me. Ruscha put this message — which we all can recognize instantly — in exactly the right context. Its impact hits dead-on.

First we see the image of beautiful mountains at sunrise and we are inspired by feelings of adventure, of aspiration, of our desire to achieve our goals in life.

But mountains are difficult to climb and we fear that we cannot achieve our goals. There’s a little sadness, a bit of uncertainty coming in now.

Then, as we feel those emotions, we read the words ‘Pay Nothing Until April’…. and we think, ‘a shortcut!’. Summiting a mountain is so difficult, perhaps beyond what we think we can do, but what if there was a shortcut to the top? That’s the lie. Bold and upfront, and a lie.

We have all seen the dozens of Buy Now Pay Later offers that flood our screens. On Amazon, Ebay, and Paypal, the most prominent check-out option is not to actually pay for your items, but to delay payment using Affirm or Klarna. The branding is new, but there is nothing new about it — BNPL is one more “fintech” variation on predatory lending. They seek to trap consumers in a cycle of debt, with interest rate and fees that are designed to increase dramatically beyond what they say when you sign up.

Believe me, I’m not trying to judge – I respect the temptation. Ruscha’s grand mountains are inspiring — who does not wish to achieve amazing heights in their life? In many contexts debt helps us towards those goals like student loans, mortgages, business loans, loans to move, loans for necessary medical treatment, etc … . What I would advise is that you use debt carefully, and only if it brings you closer to a life goal. To make sure you are not pushed towards predatory loans, build up your credit history and seek reputable lenders like Brooklyn Coop.

Ruscha’s painting is timeless. Our aspirations keep us going, motivating us through the difficulties. People might promise you a shortcut, but tread carefully. BNPL isn’t going to get you to your goal. Its just one more scam.

Samira Rajan is the longest-serving employee of Brooklyn Coop and currently its CEO. She started here as an Americorp*VISTA for a single year of service back when we were Bushwick Coop in 2001, got hooked by the challenge of building a community financial institution, and hasn’t left.

Samira Rajan is the longest-serving employee of Brooklyn Coop and currently its CEO. She started here as an Americorp*VISTA for a single year of service back when we were Bushwick Coop in 2001, got hooked by the challenge of building a community financial institution, and hasn’t left.