Be a BOSS !

Posted by Warren Goodridge, Mar 5 2022

Often when interacting with business owners, I find that there are some aspects of the business that they fail to address. Keeping up with the requirements of a formal legal entity will ensure business success.

Filing Requirements

Have you updated your Statement of Information? In the State of New York, corporations and limited liability companies (LLC) must complete a Statement of Information every two years, essentially an address update. A correct address aids the Department of State in communicating with your business in the event you are sued. Not updating your address with the State can potentially open your business to default judgements and loss of money. Also, the Statement of Information is available to other businesses, like financial institutions and suppliers, for review before entering into agreements.

The Department of State will remind you to update this form via email. But if you know you have not updated the Statement of Information in at least 2 (two) years, follow these steps:

- first check the Department of State’s public inquiry website and insert the name of your business and business entity.

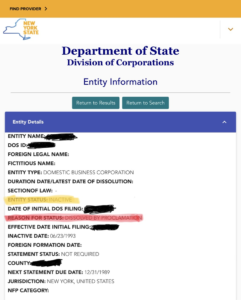

- Once you see the name of your business click the name to be taken to the Entity Information of your business shown below:

Involuntary Dissolution (Annually)

While you’re on this page, check the “REASON FOR STATUS” line. If you see “dissolved by proclamation”, pay attention!! It is likely that the business has not paid or filed franchise taxes in two years and the Secretary of State has dissolved your corporation and you are no longer a recognized legal entity in the State of New York. To fix this, you will need to complete the following:

- Contact the Corporation Dissolution Department

- File any returns that have not already been filed. If any taxes are due, they must be paid with any added penalties. Once completed you will receive the Consent for Reinstatement.

- With this, file the following with the NYS Department of State:

- Consent for Reinstatement

- Certificate of Payment of Taxes

- Then check with the Department of State to see if the corporation’s name is still available. Once the process is completed, you will be contacted by the Department of State.

Open a Bank Account

Once you have formed your business, I recommend you open a bank account for your business. It will ease bookkeeping, avoid confusion when it is time to file taxes, and better equip your defense in the event your business is litigated against. When deciding to open a business account, consider the cost. Are you able to manage the account in a way that prevents you incurring fees? Does the type of account and the features associated with the account make sense for the type of business that you have? For example, if your business is a cash heavy business, does the financial institution charge cash handling fees? You should also consider whether the financial institution provides ongoing support for your business and is able to answer questions you may have about your business.

Once your bank account has been opened you should keep all business and personal expenses separate.

Document your Expenses & Organize your Finances (Ongoing)

Whether using software or another method with which you are comfortable, record all your business transactions.

Update a Business Plan

Even if you had not created one prior to starting your business, take the time now to develop and update your business plan. Reviewing your actual income and expenses versus your expectations will give you an understanding as to whether it makes sense to continue the business. If there is something that you need to change, you know well in advance of pouring in more funds. This part is usually the hardest part for business owners to deal with but, just because the initial idea is not viable, it does not mean that you need to give up. It just means you may need to take a second look at your idea and rework it.

Business Formalities

Keep records of your business decisions and dealings. Especially as a corporation, certain formalities are required. You must adopt bylaws or rules that the organization creates to dictate the way the business functions. You must hold meetings of the Directors and record meeting minutes regarding major business decisions, and you must hold an annual shareholders meeting.

While not required, an LLC should adopt an operating agreement, record major company decisions and also hold annual membership meetings. Use a binder to store this information!

These formalities are critical because a business entity ought to be legally distinct from you as an individual. Failure to show a history of business decisions can open you up to allegations of self-dealing which could “pierce the corporate veil”, a situation where the courts can put aside limited liability and hold you personally responsible for the company’s debts and liabilities.

Update your Passwords

As a regular habit, update the passwords for your accounts regularly. Internet crime is rampant recent years and identity theft is on the rise. Changing passwords every few months and using multifactor authentication can protect your information. Having a secure process for your accounts can provide you with peace of mind that your information is safe from bad actors.